Today’s investment landscape offers a variety of opportunities for investors seeking to grow their wealth.

Among these options, the Headway Debt Fund stands out as a tool for generating risk-adjusted passive income.

But what is it?

The Headway Debt Fund: A Solution for the Busy Investor

The Headway Debt Fund is a solution for busy professionals looking for consistent monthly cash flow and liquidity.

With its focus on short-term loans, the fund offers investors liquidity, putting their money in reach when they need it. You can withdraw your capital in 90 days or less.

Our lending partner has facilitated over $200 million in loan funding, leading to the successful origination of more than 1,000 loans.

As we grow the Headway Debt Fund, we do so as active participants, with our own investment growing alongside yours.

Understanding the Headway Debt Fund Mechanism

The Headway Debt Fund functions by offering short-term loans to investors such as flippers. This mechanism allows us to provide our investors a return of 6-8%. These loans, secured by a first-position lien, are collateralized by real estate.

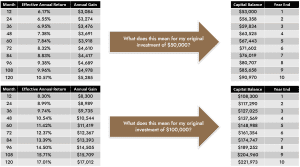

Investment in the Headway Debt Fund starts at a minimum of $25,000, which yields a 6% annual return.

For those investing $100,000 or more, the return increases to 8%.

The fund’s dividends or distributions can be reinvested to compound over time, thereby maximizing your initial investment’s power.

Here’s a look at what compounding a $50k or $100k investment could look like:

Unlike equity investments, the fund does not offer upside or equity; it’s purpose-built as a monthly cash flow play, yielding regular dividends.

Our lending partner vets each borrower and deal to uphold the highest standards and mitigate risk. Our rigorous scrutiny has led to an exceptional track record, with only one loan out of a thousand ever entering servicing.

Why the Headway Debt Fund Makes Sense

- Leverage the Power of Compound Interest

The snowball effect of compound interest is the financial ace up your sleeve. A $100,000 investment compounded monthly at an 8% interest rate could yield a sizeable return as it compounds. Each compounding cycle amplifies your principal, boosting your capital over time. - Embrace Robust Diversification

Upon entering the Headway Debt Fund, your capital is diversified across all the loans within the fund. This measure fortifies your capital security. If you have excessive cash on hand, consider investing a part into the debt fund for diversification and cash flow. - Enjoy Flexible Liquidity

Liquidity is key in an investment portfolio. The Headway Debt Fund, with its focus on short-term loans, provides liquidity to investors. It offers a balance to portfolios containing other long-term and less liquid investments such as multifamily, small businesses, or car washes.

The Wrap.. taking the next step

As we navigate the fluctuating investment terrain, the Headway Debt Fund remains an option for savvy investors looking to earn consistent cash flow on excess capital.

To learn more about the Headway Debt Fund, reach out to a member of our team at [email protected].

Let’s put your money to work!

.

When you’re ready, there are 2 ways we can help you:

1. Interested in partnering with us as a passive investor? Schedule a call with us here. We’d like to learn more about your unique investment goals.

2. Ready to apply to invest? Fill out our application here. We’ll be in touch shortly after to see if we’re a good fit for you.

** Please note, investments are for accredited investors only at this time. **